Accountant packages

Clients will inevitably have questions for you throughout the year so you should offer different levels of support at multiple price points. accounting pricing packages This type of service makes sure that the books are accurate and on time on a regular basis. It is easier to upsell your customers to more expensive levels when you have different tiers of services available. Value pricing and bundling is an obvious strategy to boost your bottom line.

Once-off Base Price*:

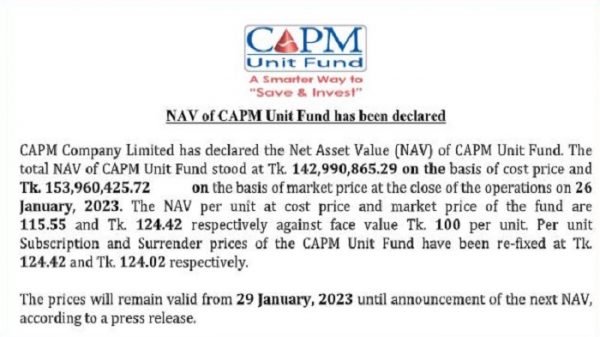

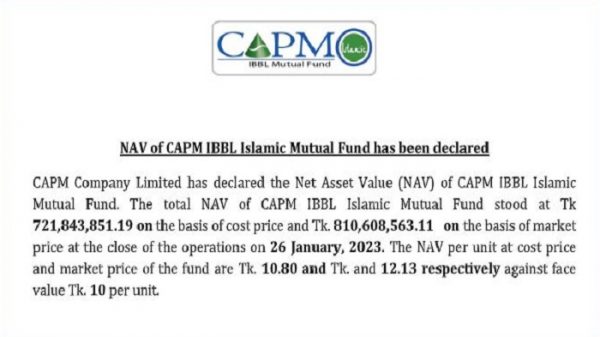

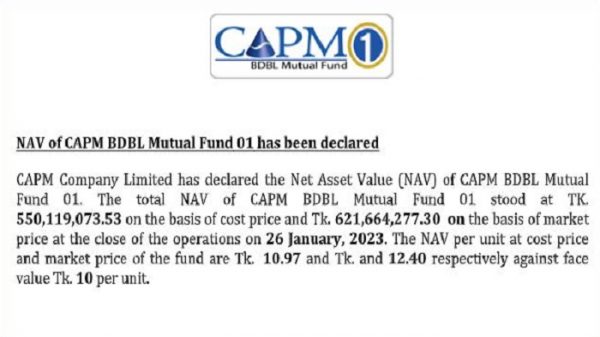

It’s the future in a changing accounting industry, where you can utilize tech to increase efficiency and output. Per-hour rate for consultations regarding tax matters and SARS audits for individual clients. The cost of tax consultantion, SARS audit typically runs from R400/hour to R1100/hour, averaging at R900/hour. We’ve also examined what the quoted prices usually include and which factors affect the final price. Cost prices and levels are updated from Supplier Invoices and Deliveries.

No Hidden Fees. No Surprises. Just Expert Accounting & Tax Services You Can Trust.

Our business budgeting services will help you map out your pathway to success, and our cashflow management and forecasting services will ensure you stay on track towards achieving your goals. Bookkeeping is essential for accurate financial records, tax compliance, and cash flow tracking. Our pricing is NOT https://www.bookstime.com/blog/key-reasons-why-your-business-should-outsource-invoicing just about revenue—it’s about real workload.

Our Customers Love Us!

QuickBooks Bridging Software supports Standard and Cash schemes. Businesses whose home currency is not GBP are currently not supported. Build up your CRM with new prospect information, and keep track of existing customers and their orders. Instantly generate quotes, and easily convert them to orders or invoices, or turn orders into invoices.

- Bookkeeping is completed fast despite the large volume of financial records, the financial reports are accurate, and communication and seamless workflow are maintained, ensuring efficiency.

- Most people don’t want the most expensive option, but they also feel dissatisfied with selecting the base option because it lacks certain features.

- Everything is automatically calculated, depending on the VAT scheme and rates chosen.

- With an hourly rate, unless you can find more hours in the day, it’s difficult—borderline impossible—to drive up profit significantly.

- We believe in transparency, so with us, you’ll always know your costs up front.

Online VAT returns

When CPAs have an ongoing relationship with clients, they can better identify these needs and offer tailored services at an additional fee. A subscription model fosters long-term relationships with clients, transforming the CPA-client dynamic from a transactional exchange into a collaborative partnership. Instead of focusing on one-time services like tax filings, CPAs can provide year-round advisory and support services, which enhance their value to clients and create a deeper bond over time. Now that you know the different pricing packages and services available, you are in a better position to decide what the best package applies to your business.

- It lets you justify your pricing, both to yourself and to your clients.

- Since 2003, he has been teaching accountants on how to improve their marketing and make more money from their accounting practice.

- We will work closely with you to ensure that the right software is used for your business and get the results you want.

- Some are more impactful than others, but they should all be considered.

- This is the average price for basic bookkeeping if your business has up to 30 transactions per month.

- However, it’s important to note that this price varies depending on the volume of work, the bookkeeper’s experience, and the range of services offered.

- At Allied Business Accountants, we do things a little differently.

- Before selecting a company, be careful not to be swayed by the low bookkeeping pricing package.

- Our ERP software automates various processes for improved efficiency, including payroll, invoicing and reporting.

- We understand that making a change to the processes of your company is difficult.

- This means that regardless of a service’s value to your clients, you’re capping your pricing based on how long it takes to deliver that service.

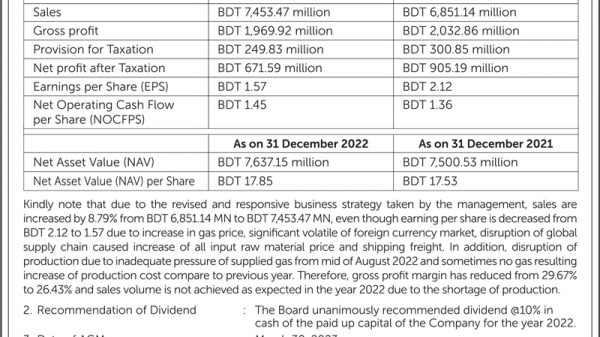

You also have the liberty to bookkeeping cost per hour and much more. If your business is in a growth phase, consider moving to full accrual accounting, with financial and management reporting to help you scale. Most of the time, you need trial balance this level of financial management not only for yourself but also for your key stakeholders, including banks, investors, and advisors.

Business Accounting Services

- Velan supports a New Jersey speciality chemical manufacturer with top-notch accounting services.

- Accountants understand that with the volume comes the complexity of managing accounts payable, which can wreak havoc on a business’s cash flow.

- Accounting Packages have a required, non-refundable fee of $175.00 to start.

- Think about the services which are necessary for you to offer in each tier to get the perfect outcome for your client.

- Not sure where to start or which accounting service fits your needs?

- Companies with multiple shareholders, international transactions, or SARS audits require higher fees.

- QuickBooks Online is great for businesses who need access to their business data from anywhere and real-time collaboration.

You can customise dashboards depending on the level of information you want to see. Highlight additional data in the form of line charts, pie charts, funnel charts, a list of statistics, or drilldown tables. Everything is automatically calculated, depending on the VAT scheme and rates chosen. Once you’ve completed the VAT return you can save it in a PDF or CSV format, print it, and submit the values to ROS. Keep on top of payments by viewing vendor and expenses on one screen. You can set up recurring payments and instantly see their status.